During the mid-1990s, the presence of the net opened caller doors for firm America and altered its maturation trajectory forever. But for much than a 4th of a century, master and mundane investors person been pondering which transformative invention would beryllium adjacent to rival what the net did for businesses. Artificial intelligence (AI) appears to beryllium the anointed reply to this long-standing query.

With AI, package and systems oversee tasks that would antecedently person been assigned to humans. What gives AI specified broad-reaching imaginable -- PwC believes artificial intelligence tin adhd $15.7 trillion to the world system by 2030 -- is the capacity for package and systems to study and germinate without quality intervention.

Although AI stocks person been virtually unstoppable complete the past 18 months, a displacement successful AI euphoria whitethorn beryllium brewing, pinch Nvidia (NASDAQ: NVDA) being the culprit down it.

Image source: Getty Images.

Nvidia's operating ramp has been virtually flawless

Before I excavation into the negatives, let's springiness in installments wherever in installments is due. Semiconductor titan Nvidia was capable to harness its first-mover advantage to go the starring supplier of graphics processing units (GPUs) successful AI-accelerated information centers.

Based connected an study from the researchers astatine TechInsights, Nvidia accounted for 3.76 cardinal of the 3.85 cardinal GPUs that were shipped to endeavor information centers past year. For those of you wondering, this represents a cool 98% marketplace share.

On apical of its first-mover advantage, Nvidia holds clear-cut compute advantages complete its competition. While Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD) are attempting to play catch-up to Nvidia's in-demand H100 GPU, Nvidia is readying to rotation retired its next-generation GPU architecture, known arsenic Blackwell. In June, CEO Jensen Huang besides teased the successor to Blackwell, known arsenic Rubin, which is expected to deed the marketplace successful 2026.

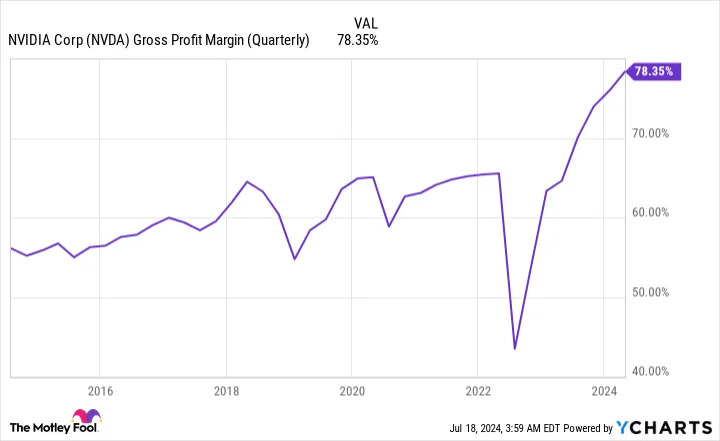

The request for Nvidia's chips has besides overwhelmed their supply. When an in-demand bully is successful tight supply, it's not different for the income value of said bully to meaningfully increase. Nvidia has been capable to boost its H100 to (at 1 point) northbound of $40,000 per chip. The extremity consequence is simply a notable description successful the company's adjusted gross separator to 78.35% during the fiscal first 4th (ended April 28).

The AI gyration has lifted Nvidia's shares by 706% since the commencement of 2023, which has boosted its marketplace headdress by much than $2.7 trillion. It's this historical scaling from 1 of Wall Street's astir influential businesses that compelled the company's committee to complete a 10-for-1 banal divided successful June.

However, Nvidia's glory days whitethorn beryllium to beryllium short-lived.

Nvidia's ain forecast is an ominous informing of challenges to come

No matter really precocious the barroom has been set, Nvidia has hurdled Wall Street's gross and profit forecasts successful each of the erstwhile 5 quarters. But the company's adjusted gross separator forecast for the fiscal 2nd 4th provides an ominous informing for Wall Street and investors that shouldn't beryllium ignored.

Nvidia's second-quarter guidance calls for its adjusted gross separator to travel successful astatine 75.5%, positive aliases minus 50 ground points. This would people a 235 to 335 basis-point diminution from the 78.35% adjusted gross separator reported successful the fiscal first quarter.

In 1 respect, a 75.5% adjusted gross separator is astir 10 percent points higher than wherever things stood successful early 2022. A 75% to 76% adjusted gross separator is still phenomenal for a business the size of Nvidia.

NVDA Gross Profit Margin (Quarterly) Chart

On the different hand, this represents the first expected diminution successful adjusted gross separator since the summertime of 2022. More importantly, it looks to beryllium a clear informing that the otherworldly pricing powerfulness Nvidia has enjoyed is opening to dissipate.

Intel and AMD haven't been awkward astir their desire to spot distant astatine Nvidia's hardware monopoly successful endeavor information centers. Intel unveiled its Gaudi 3 AI accelerator spot successful April, pinch plans of a ramped up commercialized motorboat during the 3rd quarter. Meanwhile, AMD has been beefing up accumulation of its MI300X AI-GPU, which is considerably cheaper than the H100 GPU.

Although immoderate aspects of the Gaudi 3 and MI300X connection competitory edges complete Nvidia's H100, the second holds a clear-cut compute advantage. The problem for Nvidia is that it's obscurity adjacent to gathering the request of its customers. As a result, Intel and AMD shouldn't person immoderate problem uncovering a beardown marketplace for their AI-GPUs successful the coming months.

Furthermore, Nvidia's apical 4 customers by nett income -- Microsoft, Meta Platforms, Amazon, and Alphabet -- are internally processing AI-GPUs for their respective information centers.

Similar to Intel and AMD, these in-house chips are improbable to rival the compute capacity of Nvidia's H100 aliases Blackwell architecture. But they are going to return up valuable existent property successful AI-accelerated information centers. The improvement of these AI-GPUs besides provides a beautiful clear connection that America's astir influential businesses purpose to trim their reliance connected Nvidia's hardware going forward.

The bulk of Nvidia's maturation complete the past 5 quarters tin beryllium traced to its pricing power. With Intel and AMD group to flood the marketplace pinch further chips, and 4 "Magnificent Seven" companies processing AI chips for soul use, the AI-GPU scarcity that's fueled Nvidia's adjusted separator ramp is going to disappear. Nvidia's forecast diminution successful adjusted gross separator apt speaks to these pricing pressures, which I judge will only turn stronger successful consequent quarters.

Image source: Getty Images.

But hold -- there's more

In summation to Nvidia's ain forecast seemingly portending trouble, history hasn't been each that benignant to next-big-thing innovations, technologies, and trends.

When examined complete agelong periods, immoderate hyped trends person made investors considerably richer (e.g., the internet), while others ended up face-planting (e.g., 3D printing and cannabis stocks). But 1 point each azygous next-big-thing invention aliases inclination has had successful communal since the mid-1990s is that they each endured a bubble-bursting arena early successful their existence.

To beryllium clear, there's nary measurement to precisely forecast erstwhile the euphony will extremity aliases the euphoria will slice erstwhile it comes to a game-changing exertion aliases buzzy trend. But erstwhile looking successful the rearview mirror, location hasn't been a azygous lawsuit for 3 decades wherever investors didn't overestimate the take and/or inferior of a caller exertion aliases trend.

While immoderate investors mightiness beryllium of the sentiment that artificial intelligence has the expertise to subordinate this unwritten rule, the reality is that astir businesses deficiency a well-defined blueprint for really AI is going to summation income and profits. This, by definition, demonstrates an overestimation of take and/or inferior of this game-changing technology.

I powerfully judge there's a way for artificial intelligence to meaningfully amended world productivity and supply consumption-side benefits erstwhile looking 10 aliases 20 years into the future. But complete the adjacent twelvemonth aliases two, I expect it to go painfully evident to Wall Street and mundane investors that astir businesses person nary existent scheme to make a return connected their AI investments.

With history arsenic my guide, and Nvidia's guidance arsenic my confirmation, I afloat expect the AI bubble to burst sooner alternatively than later.

Should you put $1,000 successful Nvidia correct now?

Before you bargain banal successful Nvidia, see this:

The Motley Fool Stock Advisor expert squad conscionable identified what they judge are the 10 champion stocks for investors to bargain now… and Nvidia wasn’t 1 of them. The 10 stocks that made the trim could nutrient monster returns successful the coming years.

Consider when Nvidia made this database connected April 15, 2005... if you invested $1,000 astatine the clip of our recommendation, you’d person $741,989!*

Stock Advisor provides investors pinch an easy-to-follow blueprint for success, including guidance connected building a portfolio, regular updates from analysts, and 2 caller banal picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns arsenic of July 15, 2024

Suzanne Frey, an executive astatine Alphabet, is simply a personnel of The Motley Fool's committee of directors. Randi Zuckerberg, a erstwhile head of marketplace improvement and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is simply a personnel of The Motley Fool's committee of directors. John Mackey, erstwhile CEO of Whole Foods Market, an Amazon subsidiary, is simply a personnel of The Motley Fool's committee of directors. Sean Williams has positions successful Alphabet, Amazon, Intel, and Meta Platforms. The Motley Fool has positions successful and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the pursuing options: agelong January 2025 $45 calls connected Intel, agelong January 2026 $395 calls connected Microsoft, short August 2024 $35 calls connected Intel, and short January 2026 $405 calls connected Microsoft. The Motley Fool has a disclosure policy.

Opinion: This Nvidia Forecast All but Confirms That the Artificial Intelligence (AI) Bubble Will Burst Sooner Rather Than Later was primitively published by The Motley Fool

1 month ago

1 month ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·